Background

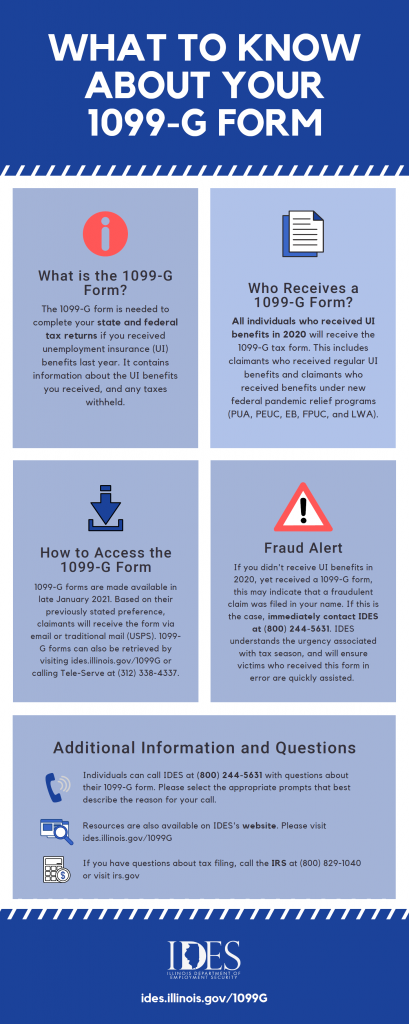

All individuals who received unemployment insurance (UI) benefits in 2020 will receive the 1099-G tax form. Claimants who collected UI benefits last year need the 1099-G tax form from IDES to complete their federal

and state tax returns. The 1099-G tax form will be available by the end of January 2021 and mailed or emailed to IDES claimants based on previously selected claimant preference.

The 1099-G form is necessary for individuals who received state and/or federal benefits. This pertains to claimants who received both regular UI benefits and benefits paid under new federal pandemic relief programs including Federal Pandemic Unemployment Compensation (FPUC), state Extended Benefits (EB), Pandemic Unemployment Assistance (PUA), Pandemic Emergency Unemployment Compensation (PEUC), and Lost Wages Assistance (LWA). How to Access the 1099-G Form

Upon establishing an IDES account, claimants are provided an option to receive their 1099-G form electronically. Those who opted for electronic delivery will receive an email notification towards the end of January 2021. This email will contain instructions to access the document from the IDES website. For those who opted NOT to receive their 1099-G form electronically, IDES will mail a paper form during the last week of January.

These claimants may also access and print their 1099-G form online by going to

ides.illinois.gov/1099G, or calling Tele-Serve at (312) 338-4337.

Fraud Warning

If an individual did not receive UI benefits in 2020, yet still received a 1099-G form from IDES, this may indicate that a fraudulent claim was filed in their name. The IRS has provided guidance to states regarding these nationwide identity theft and unemployment fraud schemes. Individuals who may have erroneously received a 1099-G form

should immediately contact IDES at (800) 244-5631.

IDES representatives will return calls on a first-in, first-out basis to ensure the fraudulent claim is shut down, and to

address the 1099-G form. Once a fraudulent claim is reported, investigated, and confirmed by IDES, the victim will not be held responsible for repaying any benefits fraudsters may have received in their name, nor will they be held responsible for tax implications resulting from a fraudulent claim. IDES understands the urgency associated with tax season and is committed to ensuring agency resources are available to assist individuals who received a form in error.

Additional Information and Questions

Additional information on 1099-G forms is available at ides.illinois.gov/1099G. For tax filing information, individuals are encouraged to call the IRS at (800) 829-1040 or visit their website at irs.gov.

Individuals can also contact the Department at 800.244.5631 and select the appropriate queue to speak with an expert:

• Select your language

• When prompted, press 2 to indicate you are an individual

• Next, press 1 if you received a 1099-G form in error, or press 2 for all other 1099-G related inquiries

If you are already awaiting a callback for a different inquiry, we will be able to handle your 1099-G related questions on that same call. There is no need to queue for an additional callback.

1) Tax fraud can result in criminal penalties. Some of the criminal activities in violations of federal tax law include deliberately underreporting or omitting income or hiding or transferring assets or income. See https://www.irs.gov/compliance/criminal-investigation/types-of-fraudulentactivities-

general-fraud. Federal criminal penalties can include fines and imprisonment. See 26 U.S.C. §7201, §7206, and §7207. Under Illinois

law, intent to defraud for tax purposes may be inferred from conduct such as concealment of assets or covering up sources of income, or any other conduct, the likely effect of which would be to mislead or conceal. See 86 Illinois Admin Code 700.330(c). State law provides penalties

for tax fraud. 35 ILCS 735/3-6.