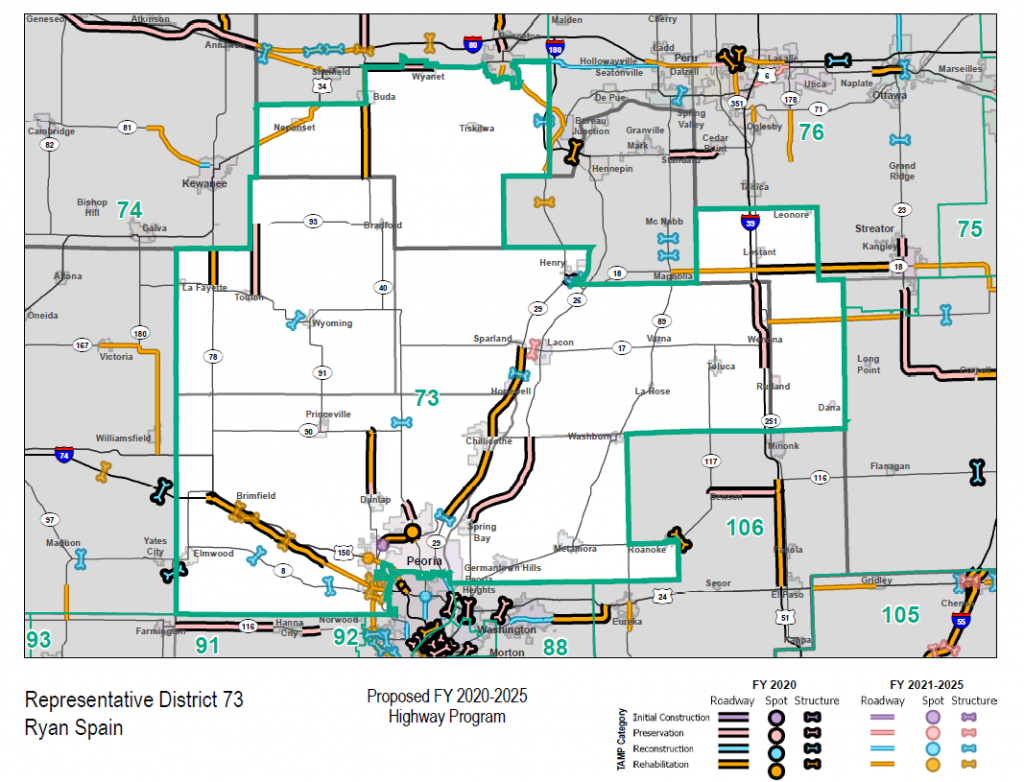

IDOT MULTI-YEAR PLAN FOR DISTRICT 73

Documents Related to the MYP & 73rd District

Summary of FY 20-25 Highway Improvement Program

Guide to Highway Project Listings

About the Multi-Year Plan

The Illinois Department of Transportation published its much anticipated Multi-Year Program (MYP) for FY20-FY25. This annual publication is the first to include the additional capital funds from the $45 billion Rebuild Illinois capital infrastructure plan that was passed and signed into law at the close of the Spring Session. The MYP contains only the state infrastructure plan for roads and bridges, and was created using a different planning model called the Transportation Asset Management Plan (TAMP), which is a risk-based asset management plan required by the National Highway System to improve or preserve the condition of the assets and the performance of the highway system. In short, TAMP prioritizes the maintenance of roads and bridges to the save the state money in an effort to maximize federal match.

The MYP program includes:

· Roadway Maintenance – $7.58 billion

· Bridges – $4.99 billion

· Safety/System Modernization – $1.59 billion

· Expansion – $3.08 billion

· System Support – $2.11 billion

The MYP is a project outlay for state spending on roads and bridges and is in addition to the roughly 68% increase that units of local government should already be receiving through the new Transportation Renewal Fund, which distributes the proceeds from the recently enacted $0.19 motor fuel tax that was enacted this year.

Roads & Bridge Dollars Protected by Lockbox Amendment

The Illinois Transportation Taxes and Fees Lockbox Amendment, passed by voters in November 2016, added a new Section to the Revenue Article of the Illinois Constitution that provides revenue generated from transportation related taxes and fees (referred to as “transportation funds”) shall be used exclusively for transportation related purposes. Transportation related taxes and fees include motor fuel taxes, vehicle registration fees, and other taxes and user fees dedicated to public highways, roads, streets, bridges, mass transit (buses and rail), ports, or airports.

This new Section was a limitation on the power of the General Assembly or a unit of local government to use, divert, or transfer transportation funds for a purpose other than transportation. It did not, and was not intended to, impact or change the way in which the State and local governments use sales taxes, including the sales and excise tax on motor fuel, or alter home rule powers granted under this Constitution. It did not seek to change the way in which the State funds programs administered by the Illinois Secretary of State, Illinois Department of Transportation, and operations by the Illinois State Police directly dedicated to the safety of roads, or entities or programs funded by units of local government. Further, the Section did not impact the expenditure of federal funds, which may be spent for any purpose authorized by federal law.